Netflix’s global subscriber count reached 282.72 million in the third quarter of 2024, which is a 14.4% year over year increase. The platform added 5.07 million new subscribers since the second quarter and is projected to end the year with a subscriber base of over 286 million.

Netflix has undergone a remarkable evolution from its humble beginnings in 1997 as a DVD rental service to revolutionizing the way people consume content. Netflix started streaming services in 2007, and now its services span 190 countries.

With an average household size of over two individuals, Netflix’s reach extends to over half a billion people!

Learn about Netflix’s subscribers’ demographics in this post.

Netflix Subscribers At A Glance

- As of Q3 2024, Netflix has 282.72 million subscribers. This marks a 1.82% increase compared to the previous quarter and a 14.4% growth compared to the same time last year.

- The United States and Canada have 84.80 million Netflix subscribers accounting for 30% of Netflix’s user base.

- The majority of Netflix’s subscribers are from Europe, the Middle East, and the African regions accounting for 96.13 million.

- An average adult spends 62.1 minutes on the platform daily.

- Netflix generates the highest average revenue per user from subscribers in the USA and Canada ($17.06)

Number Of Netflix Subscribers

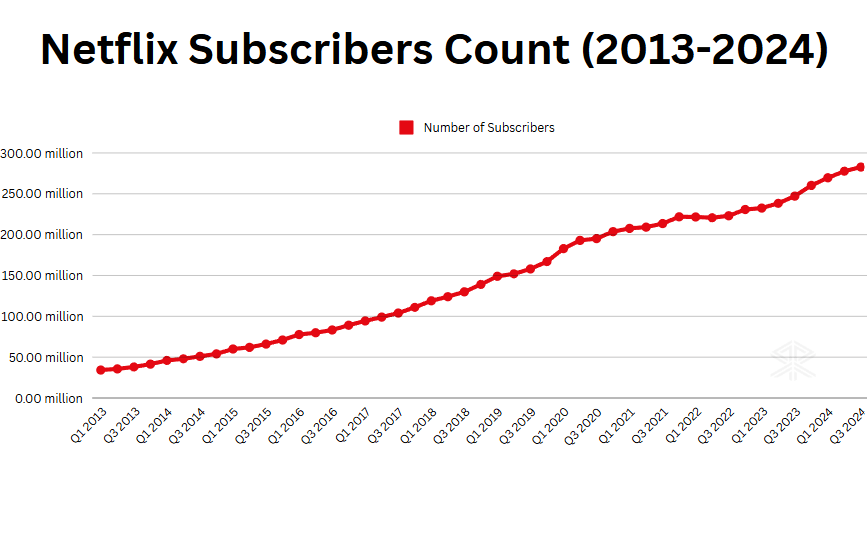

As per official data, Netflix has 282.72 million paid subscribers as of Q3 2024, this marks a 14.4% year-over-year increase and an addition of 22.44 million new subscribers in this year so far.

The biggest year-over-year jump in Netflix subscriber base occurred between 2020 and 2021, with an addition of 26.8 million subscribers, primarily driven by the pandemic-driven surge in demand for streaming services. Although the growth has slowed down since then but still remains to be in the gaining side of the spectrum.

Netflix remains the most subscribers streaming service globally.

Source: Netflix.

Growth of Netflix Subscribers over the years

| Year | Netflix Subscribers |

|---|---|

| 2024 (As of Q3) | 282.72 million |

| 2023 | 260.28 million |

| 2022 | 230.7 million |

| 2021 | 219.7 million |

| 2020 | 192.9 million |

| 2019 | 151.5 million |

| 2018 | 124.3 million |

| 2017 | 99 million |

| 2016 | 79.9 million |

| 2015 | 62.7 million |

| 2014 | 47.9 million |

| 2013 | 35.6 million |

| 2012 | 25.7 million |

| 2011 | 21.5 million |

Source: Netflix.

Quarterly Growth of Netflix Subscribers

Netflix gained 9.32 million subscribers in the first quarter of 2024, 8.05 million subscribers in the second quarter, and 5.07 million new subscribers in the third quarter of 2024, bringing its total user base tally to 282.72 million.

Netflix experienced a hiccup in its user growth during the first two quarters of 2022 when it lost 1.17 million subscribers. The recovery came in the third quarter of that year and has been growing steadily since.

Netflix is amassing new subscribers at a healthy average of 15.68% since Q3 2022.

| Time | Gain/loss from the previous quarter | Gain/loss from previous quarter |

|---|---|---|

| Q3 2024 | 282.72 million | 5.07 |

| Q2 2024 | 277.65 million | 8.05 |

| Q1 2024 | 269.60 million | 9.32 |

| Q4 2023 | 260.28 million | 13.13 |

| Q3 2023 | 247.15 million | 8.76 |

| Q2 2023 | 238.39 million | 5.89 |

| Q1 2023 | 232.5 million | 1.75 |

| Q4 2022 | 230.75 million | 7.66 |

| Q3 2022 | 223.09 million | 2.42 |

| Q2 2022 | 220.67 million | -0.97 |

| Q1 2022 | 221.64 million | -0.2 |

| Q4 2021 | 221.84 million | 8.28 |

| Q3 2021 | 213.56 million | 4.38 |

| Q2 2021 | 209.18 million | 1.54 |

| Q1 2021 | 207.64 million | 4.78 |

| Q4 2020 | 203.66 million | 8.51 |

| Q3 2020 | 195.15 million | 2.2 |

| Q2 2020 | 192.95 million | 10.09 |

| Q1 2020 | 182.86 million | 15.77 |

| Q4 2019 | 167.09 million | 8.76 |

| Q3 2019 | 158.33 million | 6.77 |

| Q2 2019 | 151.56 million | 2.7 |

| Q1 2019 | 148.86 million | 9.6 |

| Q4 2018 | 139.26 million | 8.84 |

| Q3 2018 | 130.42 million | 6.07 |

| Q2 2018 | 124.35 million | 5.45 |

| Q1 2018 | 118.9 million | 8.26 |

| Q4 2017 | 110.64 million | 6.62 |

| Q3 2017 | 104.02 million | 4.98 |

| Q2 2017 | 99.04 million | 4.68 |

| Q1 2017 | 94.36 million | 4.55 |

| Q4 2016 | 89.09 million | 5.81 |

| Q3 2016 | 83.28 million | 3.38 |

| Q2 2016 | 79.9 million | 2.19 |

| Q1 2016 | 77.71 million | 6.87 |

| Q4 2015 | 70.84 million | 4.82 |

| Q3 2015 | 66.02 million | 3.94 |

| Q2 2015 | 62.08 million | 2.46 |

| Q1 2015 | 59.62 million | 5.14 |

| Q4 2014 | 54.48 million | 3.83 |

| Q3 2014 | 50.65 million | 2.66 |

| Q2 2014 | 47.99 million | 1.86 |

| Q1 2014 | 46.13 million | 4.7 |

| Q4 2013 | 41.43 million | 3.42 |

| Q3 2013 | 38.01 million | 2.37 |

| Q2 2013 | 35.64 million | 1.4 |

| Q1 2013 | 34.24 million | N/A |

Source: Netflix.

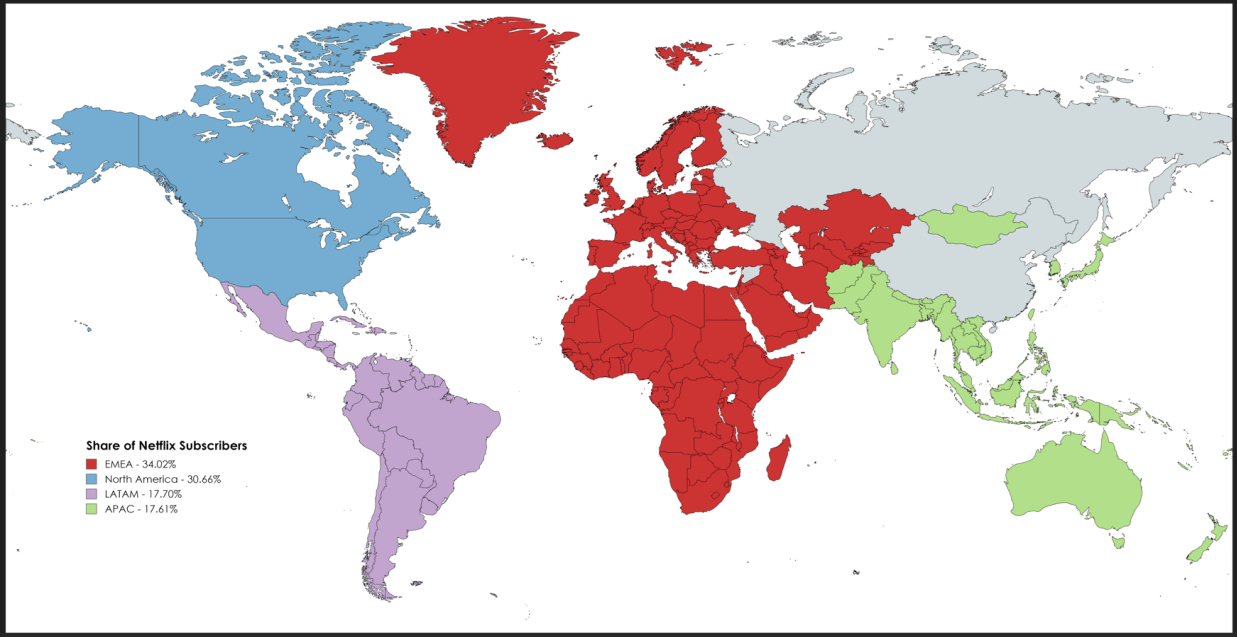

Netflix Paid Subscribers by Region

The EMEA (Europe, Middle East & Africa) region boasts the largest share of Netflix subscribers, accounting for 33.84% of the user base.

North America (USA and Canada) closely follows with a 30.29% user share.

The Latin American and Asia Pacific regions have a user share of 18.12% and 17.73% respectively as of Q2 2024.

| World Region | Number of Subscribers | Share of Netflix Subscribers |

|---|---|---|

| Europe, Middle East & Africa | 96.13 million | 34% |

| North America (USA And Canada) | 84.80 million | 29.99% |

| Asia Pacific | 52.60 million | 18.60% |

| Latin America | 49.18 million | 17.39% |

Source: Netflix.

Netflix Subscribers Growth in World Regions (Over The Years)

Netflix is growing the fastest in the Asia Pacific market, which has grown by 374.3% since 2018.

Despite holding the second-largest share of Netflix users, the North American market has experienced the slowest growth rate, with an increase of only 29.9% since 2018.

In contrast, in the Europe, Middle East, and Africa (EMEA) region, Netflix’s growth has been remarkably robust. Starting with 37.82 million subscribers in 2018, Netflix’s EMEA region saw a significant increase of 154.17%, reaching 96.13 million subscribers in Q3 2024.

The Latin American market (LATAM) went from 26.08 million subscribers in 2018 to 49.18 million in Q3 2024. That’s an impressive 88.6% increase!

Here is a table showing Netflix’s subscriber growth in different world regions:

| Year | North America (US and Canada) | EMEA | LATAM | APAC |

|---|---|---|---|---|

| 2024 (As of Q3) | 84.80 million | 96.13 million | 49.18 million | 52.60 million |

| 2023 | 80.13 million | 88.81 million | 45.60 million | 45.34 million |

| 2022 | 74.30 million | 76.73 million | 41.70 million | 38.02 million |

| 2021 | 75.22 million | 74.04 million | 39.96 million | 32.63 million |

| 2020 | 73.94 million | 66.7 million | 37.54 million | 25.49 million |

| 2019 | 67.66 million | 51.78 million | 31.42 million | 16.23 million |

| 2018 | 64.76 million | 37.82 million | 26.08 million | 10.61 million |

Source: Netflix.

Netflix Penetration in Different World Regions by 2025

Statista estimates that in 2019, about 55% of people in North America were using Netflix. This number is expected to increase to 62% by 2025.

The growth rate in the U.S. and Canadian markets is predicted to be slower compared to other regions. The penetration rate in Europe, the Middle East, and Africa (EMEA), as well as the Asia Pacific region, is anticipated to double during the same timeframe.

| World Region | Netflix Penetration in 2019 | Netflix Penetration in 2025 |

|---|---|---|

| North America (USA and Canada) | 55% | 62% |

| Latin America | 39% | 53% |

| Europe, the Middle, East, and Africa. | 19% | 41% |

| Asia Pacific | 11% | 25% |

Netflix’s Average Revenue Per User

Netflix makes the most money per paying subscriber in North America, with each user bringing in an average of $17.06.

Users in Asia Pacific bring in the lowest ARPU with $7.31.

Here is a table showing Netflix’s ARPU in different world regions:

| Year | North America (USA and Canada) | EMEA | LATAM | APAC |

|---|---|---|---|---|

| 2024 (Q3) | $17.06 | $10.99 | $8.40 | $7.31 |

| 2023 | $16.28 | $10.87 | $8.66 | $7.64 |

| 2022 | $15.86 | $10.99 | $8.48 | $8.50 |

| 2021 | $14.56 | $11.63 | $7.73 | $9.56 |

| 2020 | $13.32 | $10.72 | $7.45 | $9.12 |

| 2019 | $12.57 | $10.33 | $8.21 | $9.24 |

| 2018 | $11.15 | $10.47 | $8.23 | $9.35 |

Source: Netflix.

Distribution of Netflix Subscribers by Plan Type

7% of Netflix’s users are subscribed to the recently launched ad-supported plan, while the vast majority (93%) had an ad-free subscription.

Netflix is the leading streaming service in the United States in terms of paid subscriptions. In contrast, Peacock, the United States’s newest streaming giant has 77% of its users opting for its ad-supported plan.

| Streaming Service | Ad Supported Subscribers | Ad Free Subscribers |

|---|---|---|

| Netflix | 7% | 93% |

| Max | 19% | 81% |

| Disney+ | 19% | 81% |

| Paramount+ | 37% | 63% |

| Discovery+ | 45% | 55% |

| Hulu | 55% | 45% |

| Peacock | 77% | 23% |

Source: Statista

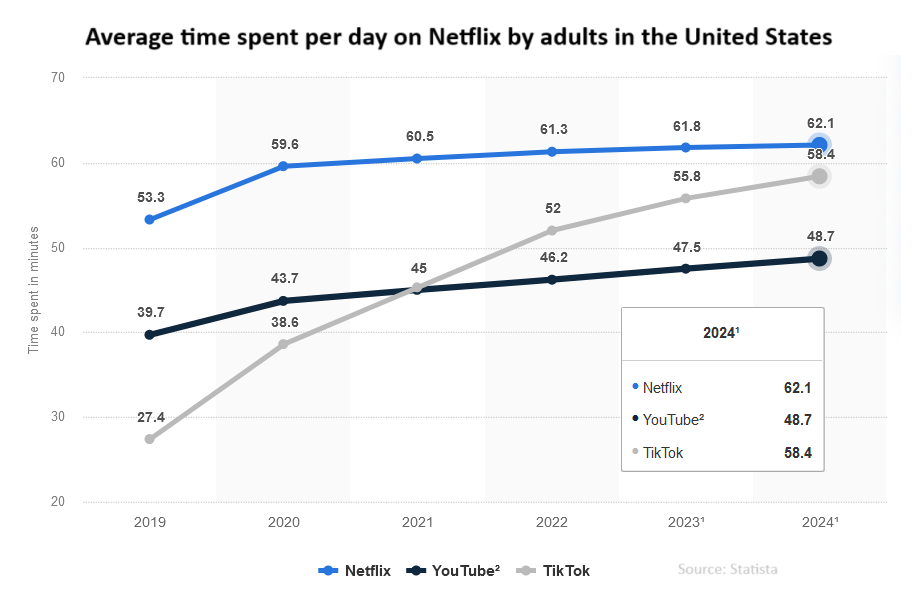

Time Spent on Netflix Every Day

An average adult in the United States spends 62.1 minutes daily on Netflix as of 2024. That equates to 31.05 hours per month and 378 hours every year!

Netflix usage has been on a steady rise over the years, people are now spending 8.8 minutes more on the platform compared to 2019.

Source: Statista

Related Read: Amazon Users Statistics 2024